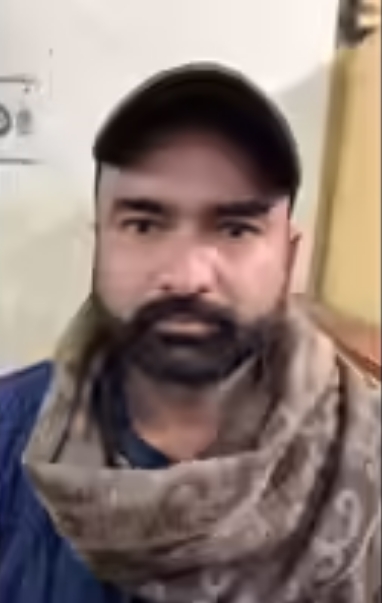

The Lucknow Cyber Crime Police have arrested a 34-year-old man, Ghazi, for allegedly operating a large-scale cyber fraud racket that spanned multiple states and defrauded more than 50 people of several crores of rupees. Among the victims was a Lucknow-based businessman who was cheated of Rs1.92 crore through fake online investment schemes.

Ghazi, a Class 10 dropout who previously worked as a milkman, is accused of floating a bogus company that existed only on paper. This shell entity was allegedly used to open multiple bank accounts to route fraud proceeds and run the operation across India.

According to police officials, seven FIRs related to cheating and fraud had already been registered against Ghazi at Gudamba police station in Lucknow. Authorities are now verifying his criminal links in Gujarat, Delhi, Madhya Pradesh, West Bengal, Odisha and Rajasthan.

The arrest was made on Tuesday by the cyber cell in connection with an FIR registered on June 2, 2025, said Brijesh Yadav, SHO of the Cyber Crime Police Station, Lucknow.

The case came to light after businessman Shalabh Pandey filed a complaint stating that he was contacted on WhatsApp by a woman identifying herself as “Bhavika Shetty.” The woman allegedly built trust through prolonged chats and phone calls before persuading him to invest in high-return online schemes.

Police said the victim was induced to transfer Rs1.92 crore through multiple transactions into different bank accounts. No returns were ever received, and the scheme later turned out to be an organised cyber fraud.

ACP Cyber Cell Saumya Pandey revealed that Ghazi admitted to using forged Aadhaar and PAN cards to open new bank accounts after his original account was frozen. He also named an accomplice, Shehzad, who allegedly helped procure fake documents and facilitate account openings.

Investigators found that Rs54 lakh of the cheated money was directly credited to Ghazi’s account. Bank analysis further revealed suspicious transactions amounting to Rs1.52 crore routed through various accounts within just one month, highlighting the scale of the racket.

Preliminary investigations suggest the gang used social media and messaging platforms to create fake profiles, impersonate investment advisers, promise unrealistic returns and siphon money through mule accounts on a commission basis.

Police confirmed that Ghazi had no legitimate business operations, and the company was merely a front to channel fraud money through multiple current accounts. Further investigation is underway to identify other members of the network.